CoinLedger overview

Crypto traders who have multiple trades across different exchanges know how much of a hassle it can be to accurately calculate their taxes. CoinLedger is the ideal tool for such traders – it integrates with major crypto exchanges, crytocurrency wallets and tax software programs like TurboTax, TaxSlayer, H&R Block, and more. It’s fast, reliable and at a modest price, it can save hours of tedious effort in accurately filing crypto taxes.

If you’re regularly trading cryptocurrency, CoinLedger is certainly worth looking into. Read our Coinledger review to help you understand how this useful piece of software can be at automating your tax reporting.

You can currently get 10% off using our code CRYPTOTAX10

What is CoinLedger?

CoinLedger is the perfect solution for crypto traders looking to make their tax calculations easier. Founded in 2018, it enables users to import data from hundreds of crypto exchanges and then processes it using IRS-approved accounting methods. This allows users to generate an appropriate tax report, such as Form 8949, to file taxes for their cryptocurrency transactions.

It also features custom integrations with popular tax filing platforms like TaxAct and TurboTax. In 2022, it was declared the Best Software for Everyday Traders.

CoinLedger provides an efficient way of managing your crypto portfolio with a consolidated view of all holdings across various exchanges and wallets on a single page. Plus, its directory of certified crypto tax accountants makes it easy to find professionals to help you out if needed. It’s the ideal solution for anyone looking to keep their crypto taxes in check.

CoinLedger – Is It Really Free?

CoinLedger offers a free starting option for its pricing tiers, enabling users to make sure that the product is suitable for them before they commit to paying. The free price also includes previews of tax reports, but users have to pay if they want to download or integrate a tax report with tax filing software.

How Does CoinLedger Work?

Crypto users that transact through multiple exchanges and crytpo wallets can find it difficult to manually input all their transcation data onto tax forms. However, CoinLedger makes this process much simpler. It allows you to import all your transactions directly from most mainstream crypto exchanges and crypto & nft wallets, or upload a CSV file if not integrated.

Manual entry is also possible and the forms will be automatically generated for you. Tax submission is made easy too since you can send the forms to TurboTax, TaxACT, TaxSlayer and H&R Block. Alternatively, if you use a different platform or CPA, simply download the tax forms and off you go!

CoinLedger Features

CoinLedger recently added Polygon to its list of integrations, allowing users of this decentralized blockchain platform to import their transaction history with just their public wallet addresses. This is great news for the many people that transact via this particular blockchain as it eliminates the hassle when it comes to tax reporting – because they’re able to automatically generate forms detailing capital gains, losses and income. All at the click of a button!

CoinLedger Pricing and Plans

CoinLedger offers four pricing tiers, all of which offer the same features but differ in transaction limits. The Hobbyist tier ($49/year) is best for those who transact rarely, with a maximum of 100 transactions supported. Next up is the Day Trader plan ($99/year), designed for users that interact with crypto on a more frequent basis (1,500 transactions allowed). Those who handle crypto in higher volumes can choose the High Volume tier ($159/year) and its 5,000 transaction limit. Finally, the Unlimited package ($299/year) allows unlimited transactions making it ideal for day or full-time traders with numerous trades to report.

You can get 10% off your plan with our code CRYPTOTAX10

CoinLedger Integrations

CoinLedger has integrated with many centralized and decentralized exchanges, wallets and tax software. This is all thanks to their use of Application Programming Interfaces (APIs) which facilitates the communication between different software tools. Not only does this enable CoinLedger to import your transactions directly from your exchange or wallet without manual inputting, but it also allows you to transfer your tax forms straight from CoinLedger to the relevant software for filing them with the government.

Tax Software

CoinLedger provides an easy and stress-free tax filing process through its integration with four major tax filing software; TurboTax, TaxACT, TaxSlayer, and H&R Block. To get started, simply select the crypto exchanges and crypto wallets you use and CoinLedger will import your transaction history to generate your crypto tax reports. These can then be uploaded to any of the four platforms which have been designed to match the data on your reports with their data columns automatically. This means you don’t need to worry about manually calculating your liabilities or inputting them – it’s all done for you!

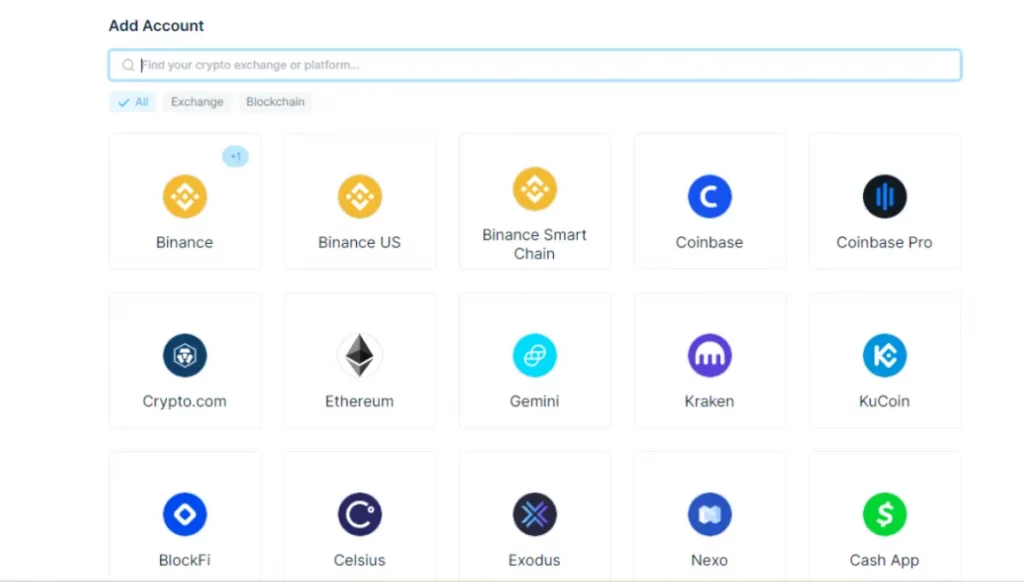

Exchanges

CoinLedger is integrated with dozens of centralized crypto exchanges, including leading platforms like Coinbase, Binance, Bitfinex, Gemini, Liquid and KuCoin. These exchanges have millions of users who may be looking for an easier way to file taxes through crypto tax software such as CoinLedger.

To connect your exchange account to CoinLedger, you simply need to provide valid API credentials in your dashboard. If this isn’t possible with your chosen exchange then don’t worry – most will allow you to download your crypto transactions in a CSV file format which can then be uploaded directly into the system and its data automatically extracted.

Wallets

CoinLedger integrates with some of the most popular DeFi wallets including MetaMask, Trust Wallet and hardware wallets Ledger and Trezor. Rather than API access, users need to manually download their transaction history in a CSV format before they can upload it into CoinLedger. Alternatively, they can provide their public wallet address and CoinLedger will collect the data manually from there. Whichever method you choose, CoinLedger will accurately generate your crypto gains/losses and income tax reports based on the imported data.

NFT

NFTs, or non-fungible tokens, are unique cryptographic assets that cannot be replicated by anyone else. They have become popular for the trading and monetization of digital art, and with buying and selling NFTS comes the need to declare any capital gains made through these transactions.

CoinLedger is well-equipped to help you do this. It integrates with NFT marketplaces such as OpenSea, so you can connect your account and let CoinLedger fetch all your transaction data automatically. If OpenSea isn’t an option for you then don’t worry – just provide your wallet address (which will be supported by CoinLedger) and it’ll automatically import your NFT transactions in one click. Once done, CoinLedger will use your trading history to calculate your NFT gains or losses over both the short and long term.

DeFi

Decentralized finance (DeFi) exchanges are direct, peer-to-peer marketplaces that allow users to trade without a third-party intermediary. Over the past year or so, these exchanges have become increasingly popular in the cryptocurrency sector and CoinLedger can be used to assist with any tax declarations arising from your DeFi trades.

For those platforms which offer an API integration with CoinLedger, you’re able to generate an authorization key that will give the software read-only access to your transaction data. If not, then simply provide a CSV file of your trades or public wallet address and CoinLedger will import them all for you.

No matter how you go about it, this platform is designed to help you keep track of all your DeFi dealings in the simplest and most efficient way possible.

CoinLedger Crypto Tax Services

CoinLedger is a great tool for quickly and accurately computing your taxes from crypto transactions. It’s as simple as feeding in the data using APIs, CSV files, mobile wallet scans or manual input – the platform will then do all the heavy lifting for you.

You can manually review the outcomes to make sure everything is accurate before generating reports which can be exported to your preferred tax filing platform for further examination. These reports are also shareable with accountants via email; they just need to create a free Tax Pro account with CoinLedger if they don’t already have one.

Should you run into any issues while working on CoinLedger, there’s always direct access to their Help Center where you can start an instant chat with the support team. Of course, you can also send the support team a message via the dedicated email address (help@CoinLedger.io).

Portfolio Tracking

CoinLedger makes it easy to track your crypto portfolio by automatically importing all transactions from multiple exchanges and blockchains. All you need to do is provide a valid API key and secret, and CoinLedger will quickly process the data and import transactions into a single dashboard.

Furthermore, CoinLedger’s classification feature ensures that none of your crypto transactions gets lost in the mix come tax season – it can accurately distinguish between taxable income from crypto gains (such as staking rewards) and non-taxable transfers (like self-wallet transfers).

Plus, this platform calculates the cost basis of each transaction for capital gains or losses calculations. However, if certain deposits or withdrawals appear unclear, users may have to manually classify them. This notwithstanding, CoinLedger remains an invaluable tool for portfolio tracking.

Tax Loss Harvesting

CoinLedger simplifies the process of tax loss harvesting by providing a comprehensive overview of unrealized losses. The app compares your cost basis to current market prices and compiles these data into an easy-to-understand report in the tab for tax-loss harvesting. This allows users to easily identify which investments need to be sold at a loss, thereby reducing their capital gains from crypto trading.

Once the transactions are sold, CoinLedger can import them and automatically re-run a tax report with updated results that show how much net gains have been reduced. It’s far more efficient than manually calculating unrealized losses – all you have to do is trust in CoinLedger!

Invite Your Tax Professional

CoinLedger allows users to easily grant access to their tax reports and portfolios to certified accountants and professionals. All the tax professional needs is a free Tax Pro account, which they can create on CoinLedger. Invitations can be sent via email, allowing the professional to have full access to the user’s tax reports.

For those who need help finding an accountant, CoinLedger also provides a directory of certified accounting professionals that are available for hire. Additionally, it flags any transactions with missing cost basis so that these can be added before downloading completed tax forms in one single click.

CoinLedger Crypto Tax Reports

CoinLedger’s main function is to dig into your transaction history, classify the transactions, and report them on their respective tax forms.

CoinLedger is an essential tool for crypto investors, as it automates the process of generating various tax reports. This includes:

Audit Trail Reports to verify transactions,

IRS Form 8949 to report capital gains and losses,

Short- and Long-Term Gains Reports based on a user’s jurisdiction,

Cryptocurrency Income Reports for all earnings received in cryptocurrencies, and

Tax Loss Harvesting to save on taxes by harvesting unrealized losses. All of this would otherwise be done manually and take a lot of time and effort.

How Does CoinLedger Compare to Other Crypto Tax Services?

CoinLedger isn’t the only crypto tax software on the market and users have many options to choose from. TokenTax and CoinTracker are two popular competitors that provide their own advantages.

TokenTax has integration with TurboTax, but its plans are significantly more expensive than CoinLedger’s. Meanwhile, CoinTracker is less expensive but doesn’t offer as much in terms of support for DeFi exchanges. It pays to compare each platform carefully before making a decision.

CoinLedger vs. TokenTax

Comparing TokenTax and CoinLedger, the former is more expensive but also provides a few unique features. TokenTax’s highest tier comes with live consultations with tax experts, while CoinLedger doesn’t include that in its plans.

In addition to this, TokenTax’s priciest plan caps the transaction limit at 30,000, whereas CoinLedger allows you to import an unlimited number of transactions. You must pay an additional $199 for every 20,000 transactions over that limit on TokenTax.

Moreover, it has its own team of in-house tax experts ready to help users file their full returns starting from $1,000 annually. This is helpful for those who trade large sums and may require external assistance. CoinLedger, on the other hand, offers a directory of accountants but doesn’t provide any in-house tax experts.

In conclusion, TokenTax is an ideal choice for high-frequency traders that need help with their taxes and don’t mind paying more. For everyday users, CoinLedger is the better option given its lower cost and simpler tax features though.

You can try Token tax with our 10%

CoinLedger vs. CoinTracker

CoinTracker is cheaper than CoinLedger but it also has limited functionality. For example, its highest tier costs $199 per year and allows a maximum of 1,000 transactions. To get more, you’d have to pay extra fees that can add up quickly. On the other hand, CoinLedger lets you import an unlimited amount of transactions for just $299 each year.

Moreover, it only has direct integration with DeFi exchanges on its pricier plans while CoinLedger supports all major exchanges out of the box. Lastly, it integrates with three tax filing platforms including TurboTax, TaxACT and Wolters Kluwer making it ideal if you use one of those to file your taxes for ordinary income.

Final Thoughts on CoinLedger

CoinLedger is an economical way of generating accurate tax reports for your cryptocurrency transactions. Its $299 annual fee provides access to all major exchanges and wallets, making it a great choice for those who frequently trade with crypto. Plus, you don’t have to spend time manually calculating everything–CoinLedger will do that automatically.

In contrast, CoinTracker offers a free tier that allows users to analyze up to 25 transactions without charge. While this could work in some cases, it’s mainly meant for people with smaller numbers of transactions that require a basic report quickly.

FAQ

Is CoinLedger accurate?

Yes, CoinLedger is a highly accurate crypto tax platform. All calculations are done accurately according to the latest IRS tax rules and regulations so that you don’t have to worry about any errors or mistakes in your filing. Furthermore, it has a dedicated team of certified tax professionals who make sure your reports are 100% compliant with the law. This ensures that you’re always in good standing with the authorities and paying any crypto taxes due on time.

Does CoinLedger work with TurboTax?

Yes, CoinLedger is integrated with TurboTax, one of the most popular tax filing platforms. This allows you to synchronize your crypto transactions and generate accurate reports quickly and easily. All you have to do is enter your information into the platform and it’ll do all the work for you, import transactions, including calculating any taxes due on your trades. With this integration, you don’t have to worry about missing out on deductions or making mistakes in your filings that could lead to problems down the line.